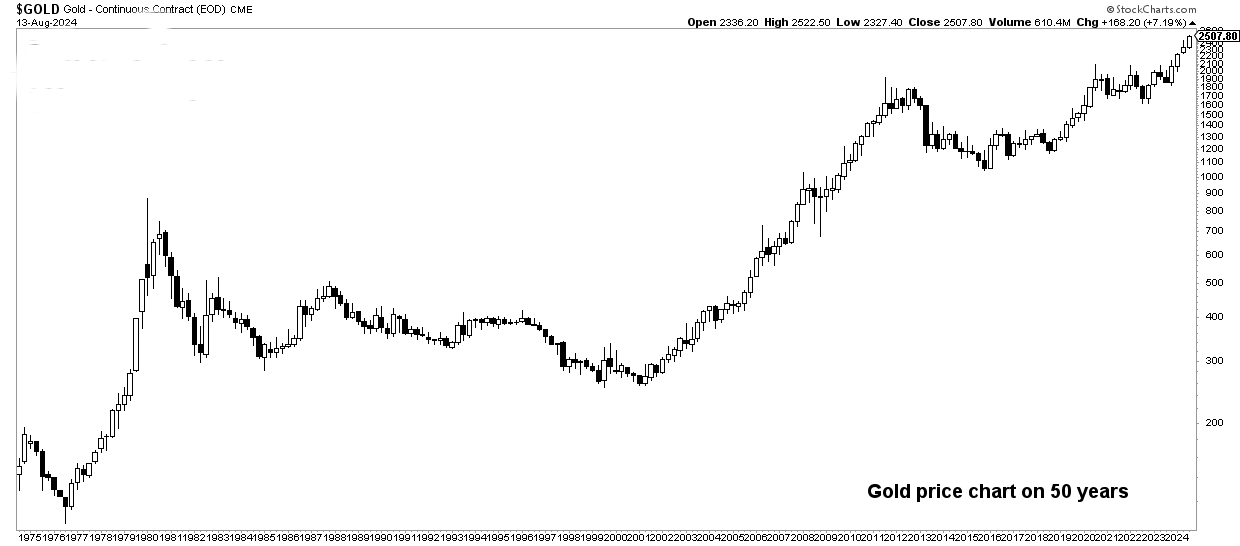

Do you know the Profit Potential of investing in Gold?

Eventually, gold could approach $5,120 by 2030!

Our gold price prediction for the coming years remains firmly bullish. Some periods of weakness characterized by gold price pullbacks can be expected. Gold price targets: $3,260 in 2025, near $3,775 in 2026, peak gold price prediction of $5,120 by 2030.

Why Gold?

Investing in Gold is one of the safest strategies to build long term wealth.

Most Stable appreciating asset.

Our streamlined investment process ensures fast, efficient service, helping you achieve your financial goals quickly.

Investment strategies.

We deliver the highest quality financial management, ensuring your investments grow with precision, care, and expertise.

Focused Solutions

Our Innovative Investment Solutions are designed to optimize your Goals and help you achieve long-term success.

We Aim To Be The Best Investing Resource to meet your needs.

We are committed to becoming the world’s leading investment advisor regarding Gold acquisitions by delivering exceptional results and personalized strategies.

Our goal is to help you achieve financial success with confidence and trust in our expertise.

Tailored Investment Solutions to meet your Financial Goals.

Expertise You Can Trust. With Decades of Experience and Top Tier Service.

Saving Strategies

Our saving strategies help you grow wealth efficiently and securely.

Competitive Price

We offer competitive pricing to maximize your investment returns and growth.

24/7 Support

Our 24/7 support ensures you're never alone in managing investments.

What Our Clients are Saying...

Here's what our clients have to say about their experience with our investment services:

The personalized attention and expertise I received helped me achieve financial growth I never thought possible.

James Smith

Retired USAF Pilot

Working with Derek has transformed my financial outlook—He truly understand my goals and needs.

Rachel Lee

Hedge Fund Manager

Their strategic approach to managing my investments has given me peace of mind and consistent returns.

Michael Chen

College Student / Investor

Quick Links

Home

About Us

Services

Useful Links

Testimonials

FAQs

Blog